connect. detect. alert.

Collective Intelligence

to Combat

Financial Crime.

Veradat is a decentralized platform designed for banking institutions that enables the secure exchange of intelligence.

ES

Closing Ranks Through Collaboration:

The lack of information exchange between banks allows individuals and entities involved in financial crimes to continue operating even after being detected.

Intelligence sharing within the banking industry is essential to prevent individuals and entities with criminal intent from operating across multiple institutions.

Veradat allows its members to exchange information on individuals or entities exhibiting behaviors possibly linked to financial crimes.

Access to collective intelligence allows participating banks to more accurately determine risk profiles and establish risk mitigation measures throughout the client’s lifecycle.

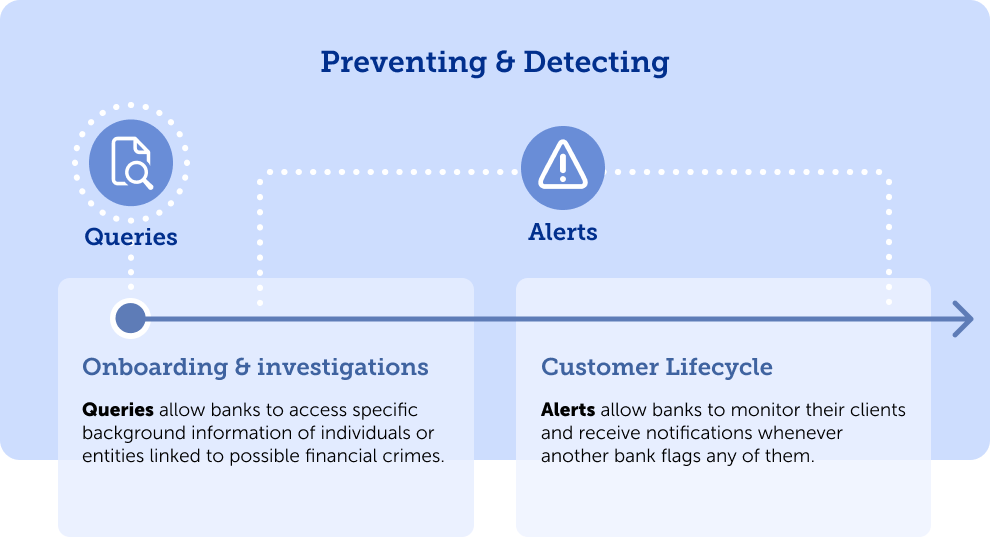

Use Cases

Onboardings

During the onboarding process, the client’s risk assessment will be strengthened.

Investigations

During investigations, to complement the client’s risk profile.

Client’s lifecycle

Throughout the client’s lifecycle, alerts will be received if another bank flags any client.

Use Cases

Onboardings

During the onboarding process, the client’s risk assessment will be strengthened.

Investigations

During investigations, to complement the client’s risk profile.

Client’s lifecycle

Throughout the client’s lifecycle, alerts will be received if another bank flags any client.

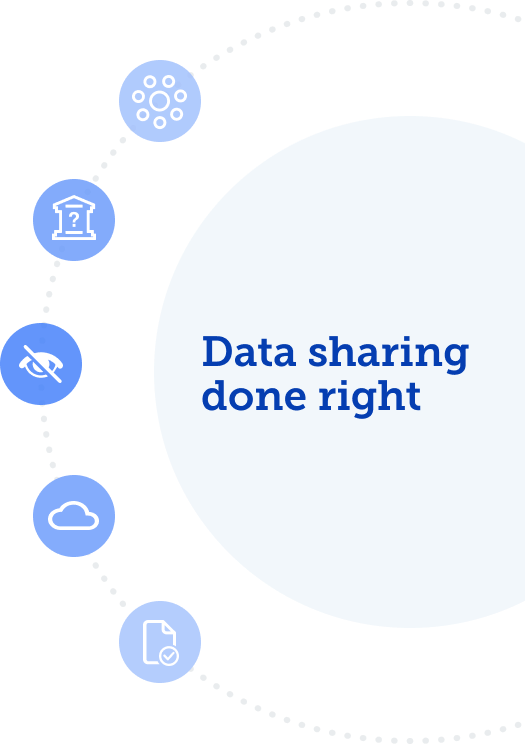

Decentralized.

Anonymous.

Secure.

Decentralized Platform

Each bank’s information is stored and processed on its own servers without relinquishing any control.

Anonymous

The platform maintains the privacy and anonymity of participants in the exchange, preventing potential conflicts of interest.

Blind Central Node

Veradat is a blind central node that acts solely as a router and never has access to the information flowing through the network or stored by the banks.

Cloud Agnostic

Compatible with on-premise infrastructures or any public or private cloud.

Standardized Data

Standardizes and streamlines information for usability.

Decentralized.

Anonymous.

Secure.

Blind Central Node

Veradat is a blind central node that acts solely as a router and never has access to the information flowing through the network or stored by the banks.

Anonymous

The platform maintains the privacy and anonymity of participants in the exchange, preventing potential conflicts of interest.

Standardized Data

Standardizes and streamlines information for usability.

Decentralized Platform

Each bank’s information is stored and processed on its own servers without relinquishing any control.

Cloud Agnostic

Compatible with on-premise infrastructures or any public or private cloud.

Benefits

Veradat allows banks to streamline risk assessments while promoting synergies and trust within the financial system.

Efficiency

Significantly enhances the detection of crimes and “high-risk individuals”, reducing losses for banks and clients.

Enhanced Reputation

Significantly enhances the overall image of the banking sector with correspondent banks and authorities.

Collective Intelligence

Allows the entire banking sector to benefit from the analysis and investigations of each bank, thereby increasing the effectiveness of the industry as a whole.

Herd Immunity

Eliminates the risk of displacement between banking entities and reduces the risk of contagion to correspondent banks.

Statistical Models Enhancement

Incorporates valuable information from new sources into risk determination statistical models, significantly increasing their effectiveness.

Benefits

Veradat allows banks to streamline risk assessments while promoting synergies and trust within the financial system.

Efficiency

Significantly enhances the detection of crimes and “high-risk individuals”, reducing losses for banks and clients.

Herd Immunity

Eliminates the risk of displacement between banking entities and reduces the risk of contagion to correspondent banks.

Enhanced Reputation

Significantly enhances the overall image of the banking sector with correspondent banks and authorities.

Statistical Models Enhancement

Incorporates valuable information from new sources into risk determination statistical models, significantly increasing their effectiveness.

Collective Intelligence

Allows the entire banking sector to benefit from the analysis and investigations of each bank, thereby increasing the effectiveness of the industry as a whole.