connect. detect. alert.

Fighting financial crime

through collective intelligence

Veradat is an intelligence-sharing platform for financial institutions, facilitating secure access to key data from multiple private watchlists to combat financial crime.

What do we do?

We enable banks to alert other banks about customers exhibiting behavior that could be linked to financial crime.

How do we do it?

Through a collaborative and decentralized platform where information from private watchlists is exchanged.

Why do we do it?

So financial criminals will no longer be able to move from one bank to another after being detected.

The need to eliminate blindspots

The lack of information sharing among banks creates a blind spot that financial criminals exploit to continue operating even after being detected by one or several institutions.

This emphasizes the need for cooperation to combat financial crime.

What is a private watchlist?

Every financial institution has a proprietary watchlist to track clients involved in suspicious activities related to fraud, money laundering, and terrorism financing.

Veradat enables institutions to access the intelligence from these watchlists while keeping the source of information private.

The need to eliminate blindspots

The lack of information sharing among banks creates a blind spot that financial criminals exploit to continue operating even after being detected by one or several institutions.

This emphasizes the need for cooperation to combat financial crime.

What is a private watchlist?

Every financial institution has a proprietary watchlist to track clients involved in suspicious activities related to fraud, money laundering, and terrorism financing.

Veradat enables institutions to access intelligence from these watchlists while preserving the confidentiality of the client data and the anonymity of the source institution.

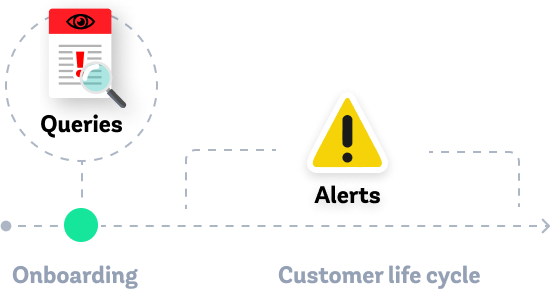

Main functionalities

Veradat allows banks to share their clients’ background information without revealing anyone’s identity. It offers two key functionalities, both of which maintain strict confidentiality and anonymity of client data:

Queries allow financial institutions to access specific background information about clients listed in the watchlists of other banks.

Alerts allow financial institutions to monitor their client base and receive notifications whenever a client is added to another institution’s watchlist.

Financial neighborhood watch in action:

Veradat functions like a neighborhood watch for financial institutions. As more banks join the network, the ‘neighborhood’ becomes safer.

This discourages financial criminals, who will increasingly find that their actions at one bank could have consequences at others, encouraging them to target non-member institutions instead.

Financial neighborhood watch in action:

Veradat functions like a neighborhood watch for financial institutions. As more banks join the network, the ‘neighborhood’ becomes safer.

This discourages financial criminals, who will increasingly find that their actions at one bank could have consequences at others, encouraging them to target non-member institutions instead.

The right balance between

transparency and privacy

Veradat is a decentralized platform where each bank has its own node for processing and encrypting information. This means each institution maintains control over its data.

Banks’ information is secure because:

- Personally Identifiable Information (PII) found in watchlists and client lists is hashed within each node to protect it from the point of origin.

- Veradat acts as a router, securely transporting these hashed values to compare them with the records stored in each node.

By following this operational approach, Veradat ensures the security of client information and maintains anonymity for the data providers.

Data sharing done right

Veradat tackles key challenges faced by banks in information sharing:

- Reputational damage

- Risk of exposing sensitive customer data

- Non-standardized information

- Lack of secure technology infrastructure